child tax credit 2022 qualifications

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. For 2018 - 2021 Returns the ACTC is worth up to 1400.

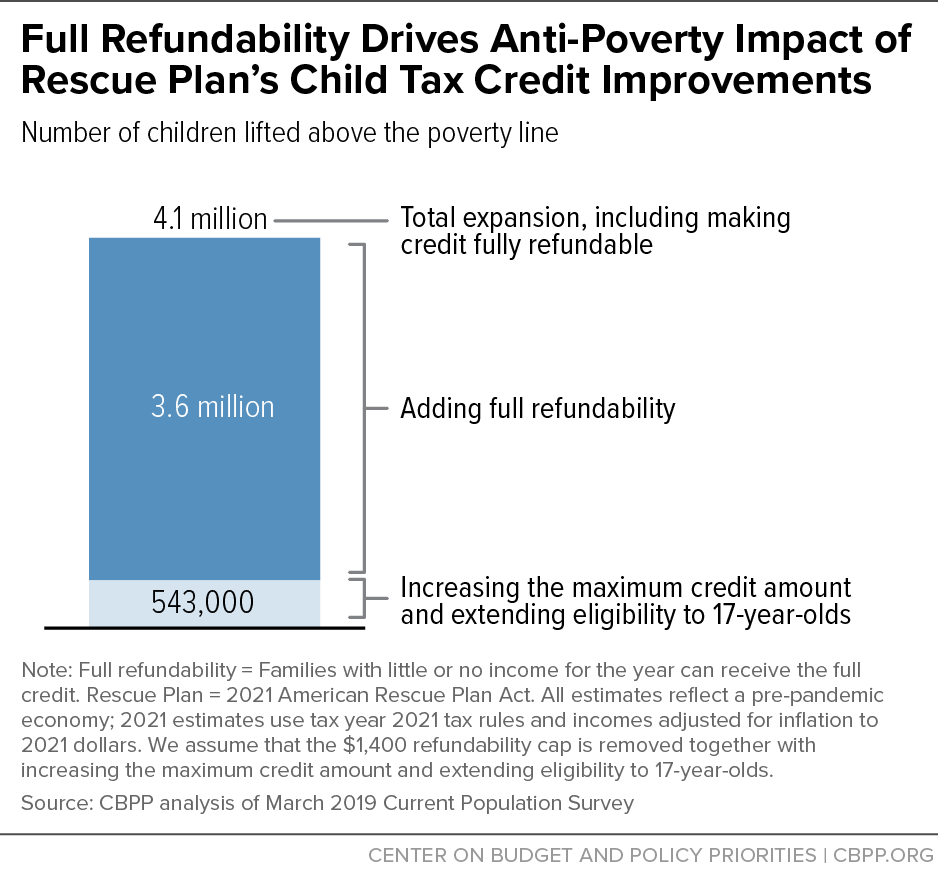

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

The IRS deadline for the 2022 tax year is April 18 2022 you can file for the child tax credit when you submit your income tax return.

. Californias newest tax credit which will give 1000 to former foster youth ages 18 through 25 is estimated to benefit 20000 residents beginning in the 2022 tax year. However in 2021 the offset became 3000 for children aged 6 to 17 years old and 3600 for children aged five or younger. These people qualify for the full Child Tax Credit.

The rebate caps at. Be your own child adopted child stepchild or foster child. Frequently asked questions about the Tax Year 2021Filing Season 2022 Child Tax Credit.

After those thresholds the credit reduces by the same 50 for every 1000. This credit is only available for children under age 6. For 2022 Returns it will be worth up to 1500.

If you dont meet the main home requirements outlined in Q A10 you may still qualify for a 3000 or 3600 Child Tax Credit for each qualifying child. As part of the American Rescue Act signed into law by President Joe Biden in March of 2021 the child tax credits were expanded to up to 3600 per child from the previous 2000. The newly passed New Jersey Child Tax Credit Program gives families with an income of 30000 or less a refundable 500 tax credit for each child under 6 years old.

150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower. Potential Changes to Child Tax Credit in 2021 More monthly payments. This amounts to 3600 for children aged five and younger at the end of 2021 and 3000 for children aged six to 17 at the end of 2021.

112500 if you are filing as a head of household. For your children to qualify you for a Child Tax Credit they must. Due to the American Rescue Plan Act of 2021 the credit increased from 2000 per child to 3600 for children under 6 and 3000 for those aged 6 to 16.

In 2022 you can qualify for the full 2000 child tax credit if your MAGI is below 200000 for single filers or 400000 for joint filers. Not have turned 18 before January 1 2022. These FAQs were released to the public in Fact Sheet 2022-28PDF April 27 2022.

The child and dependent care tax credit is a percentage based on your adjusted gross income AGI of the amount of work-related childcare expenses you paid during the year. Child Tax Credit For 2022. From 2018 till 2020 an offset was worth 2000 per child for children aged up to 16 years or younger under the child credit tax.

Everything is included Premium features IRS e-file 1099-MISC and more. The expanded California Earned Income Tax Credit CalEITC the Young Child Tax Credit and the federal EITC can combine to put hundreds or even thousands of extra dollars in your pocket. Eligible families can now apply for a one-time tax rebate to receive 250 for each child under age 18.

While not everyone took advantage of the payments which started in July 2021 and ended in. The Child Tax Credit was only partially refundable prior to 2021 with this being up to 1400 per qualifying child and you needed at least. If the amount of the credit exceeded the tax that was owed the taxpayer was generally eligible to receive a refund for the excess credit amount up to 1400 per qualifying child.

-Married couples with income under 150000 -Families with a single parent also called Head of. Thats money you can use for rent school tuition utilities. 21st Jul 2022 1231.

There will no longer be advance payments of the credit. This means that a parent or guardian is eligible to claim them for purposes of the Child Tax Credit. The Additional Child Tax Credit or ACTC is a refundable credit that you may receive if your Child Tax Credit is greater than the total amount of income taxes you owe as long as you had an earned income of at least 2500.

Child tax credit payments will revert to 2000 this year for eligible taxpayers Credit. When calculating the dependent care tax credit you may use up to 3000 of dependent care expenses if you have one qualifying dependent and up to 6000 if you have two or more dependents. In 2020 eligible taxpayers could claim a tax credit of 2000 per qualifying dependent child under age 17.

Those families who werent eligible for monthly advance payments in 2021 of up to 300 will receive the full credits in 2022 instead. Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit 2022 Could You Be Eligible For 750 From Your State Cnet

Ertc Deadline For Rebates Free Eligibility Test How To Claim Your Tax Credits In 2022 Tax Credits Rebates Tax Free

Irs Mandates Additional Requirements For R D Tax Credit Refund Claims Send2press Newswire

Child Tax Credit Definition Taxedu Tax Foundation

Tax Credit Definition How To Claim It

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

The Child Tax Credit Toolkit The White House

Can Poor Families Benefit From The Child Tax Credit Tax Policy Center

House Bill Takes Major Steps Forward For Children Low Paid Workers Center On Budget And Policy Priorities

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Childctc The Child Tax Credit The White House

House Bill Takes Major Steps Forward For Children Low Paid Workers Center On Budget And Policy Priorities

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

The Child Tax Credit Toolkit The White House